Market volatility, investments and taxes

Why do I have a tax bill for my investment even when the value has dropped?

During times of volatility, it’s natural for investors to worry that their investments will lose value – in fact they may even expect a decline at times. What’s unexpected, however, is getting a tax bill for an investment that has dropped in value. Many mutual fund and segregated fund investors may wonder why this happens.

The reason is fairly straightforward. The fund has either received income (interest or dividends) from its underlying investments during the year, or the portfolio manager sold underlying investments, realizing a capital gain. Even though the price of the fund has dropped, the income from transactions that have occurred throughout the year must be passed along to investors, and that income is taxable.

Here are a couple of examples of how this works:

The fund earns income

Receiving taxable income in a down market is like owning an apartment building. The value of the building may be lower now than when you purchased it, but you must declare any rent you collect as income. The principle is the same when it comes to investment funds. Mutual funds and segregated funds report dividends or interest that they receive from the investments they hold, and investors will be taxed on this dividend or interest income.

The fund realizes capital gains

Capital gains and losses can be a complicated topic, but the following scenarios can help clarify how they work.

Scenario 1: If you hold a share directly, you only pay tax when you sell it.

A mutual fund or segregated fund is made up of a variety of stocks and securities with many investors. For simplicity, we’ll assume that the fund has only one stock and you are the only investor.

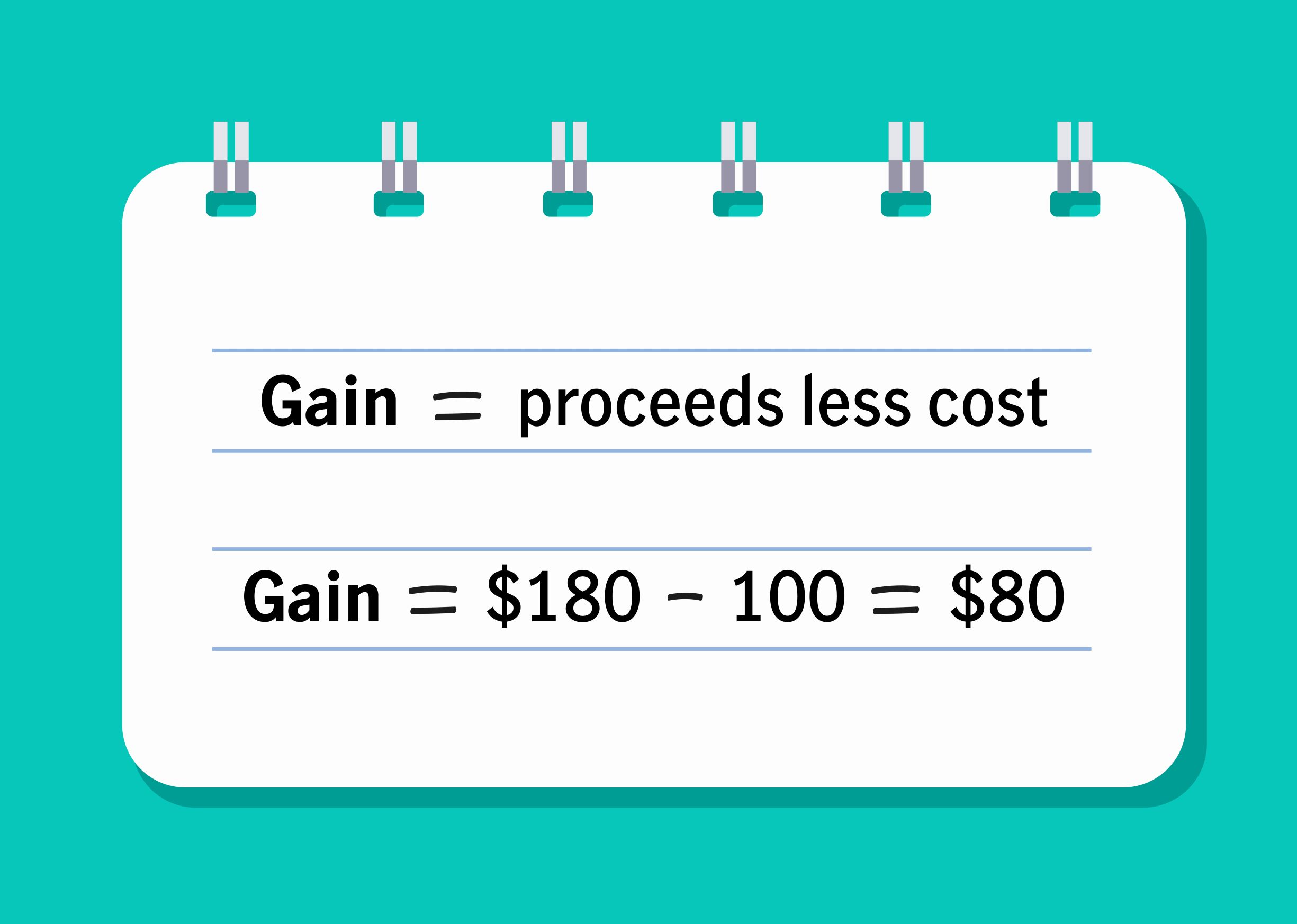

Let’s say you purchase the fund for $100 and sell it later for $180. Because you’ve sold it at a profit, you’ll receive a tax slip showing a capital gain of $80.

Scenario 2: You may receive a tax bill even if you don’t sell.

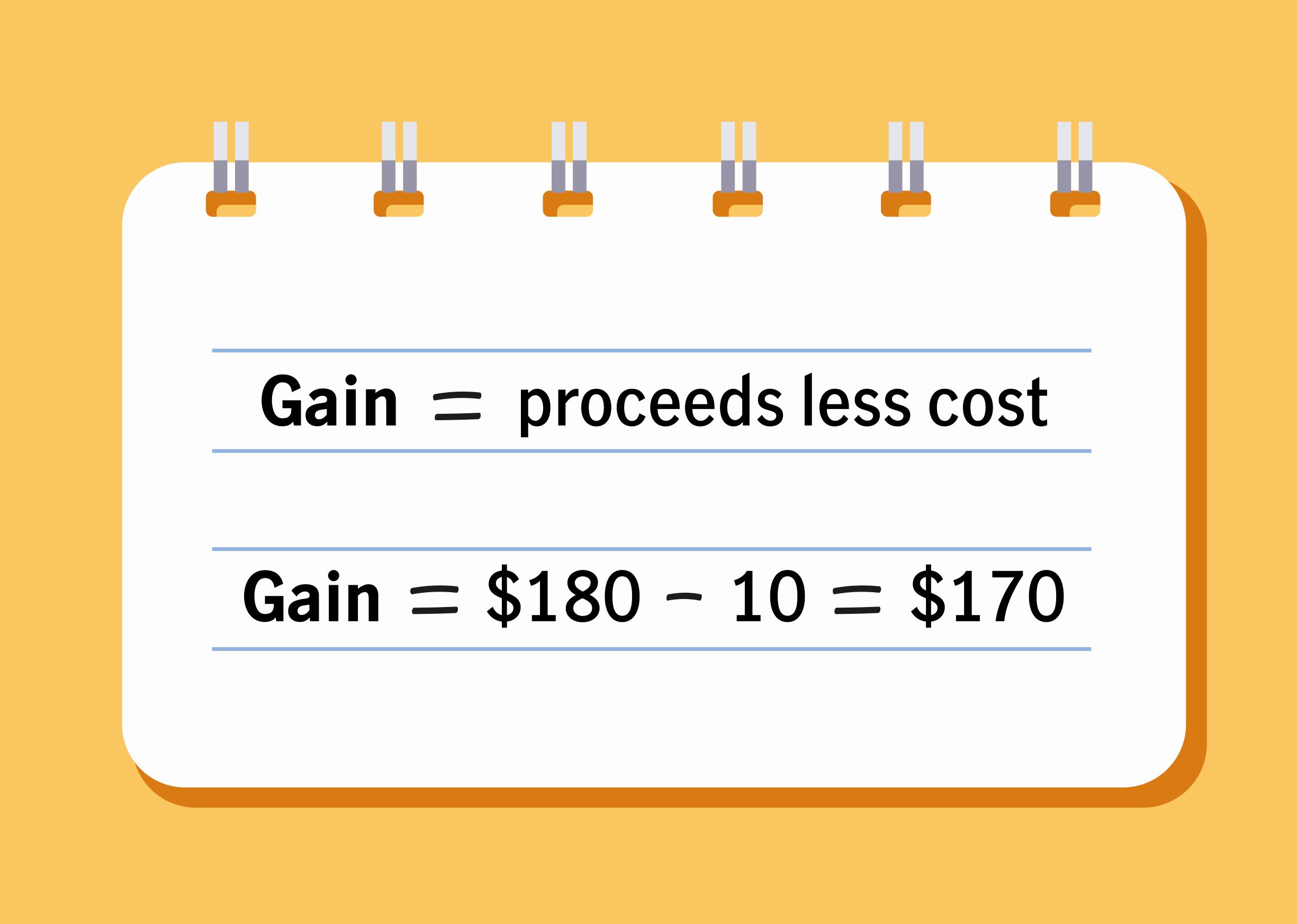

An investor is taxed on a fund’s trading activity. In this scenario, you buy a fund for $100, but the fund manager purchased this particular stock years earlier for $10.

The fund manager sells the stock later for $180 and the fund realizes a gain of $170. By law, this gain is passed on to the investors. If you were the only investor, you’d receive a tax slip for a capital gain of $170 even though you’ve only seen an increase of $80 since your purchase.

Thus, not only will you be taxed when you sell the fund, but you’ll also be taxed on gains realized if the fund manager sells underlying securities.

Scenario 3: You may receive a tax bill even if your investment drops in value.

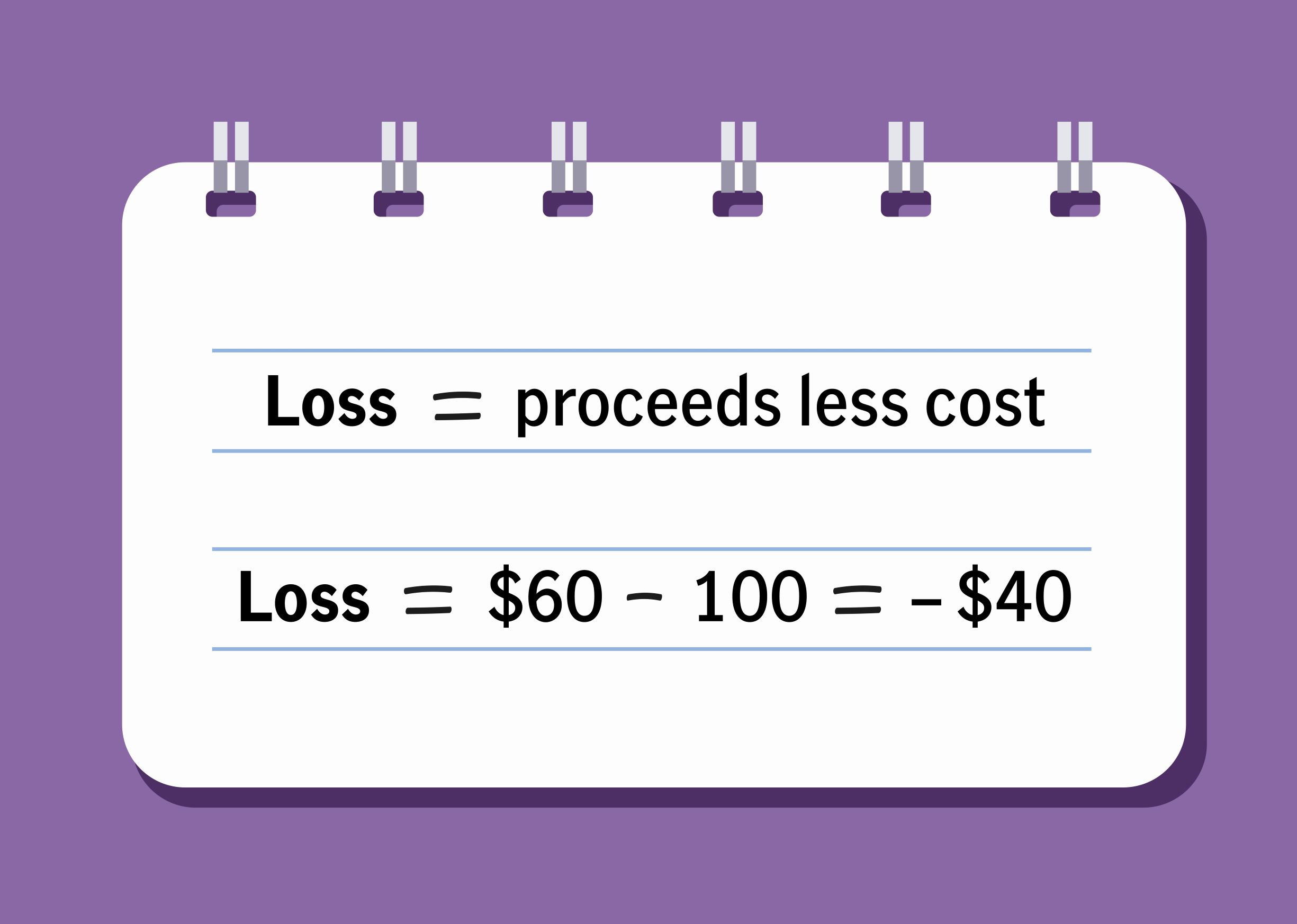

Expanding on scenario 2, let’s suppose the fund drops in value after you buy it. If you recall, your purchase price was $100 and the fund manager’s purchase price was $10. After you bought the fund, the value dropped to $60. If you sold it at this time, you’d receive a capital loss of $40 – the difference between your purchase price ($100) and the selling price ($60).

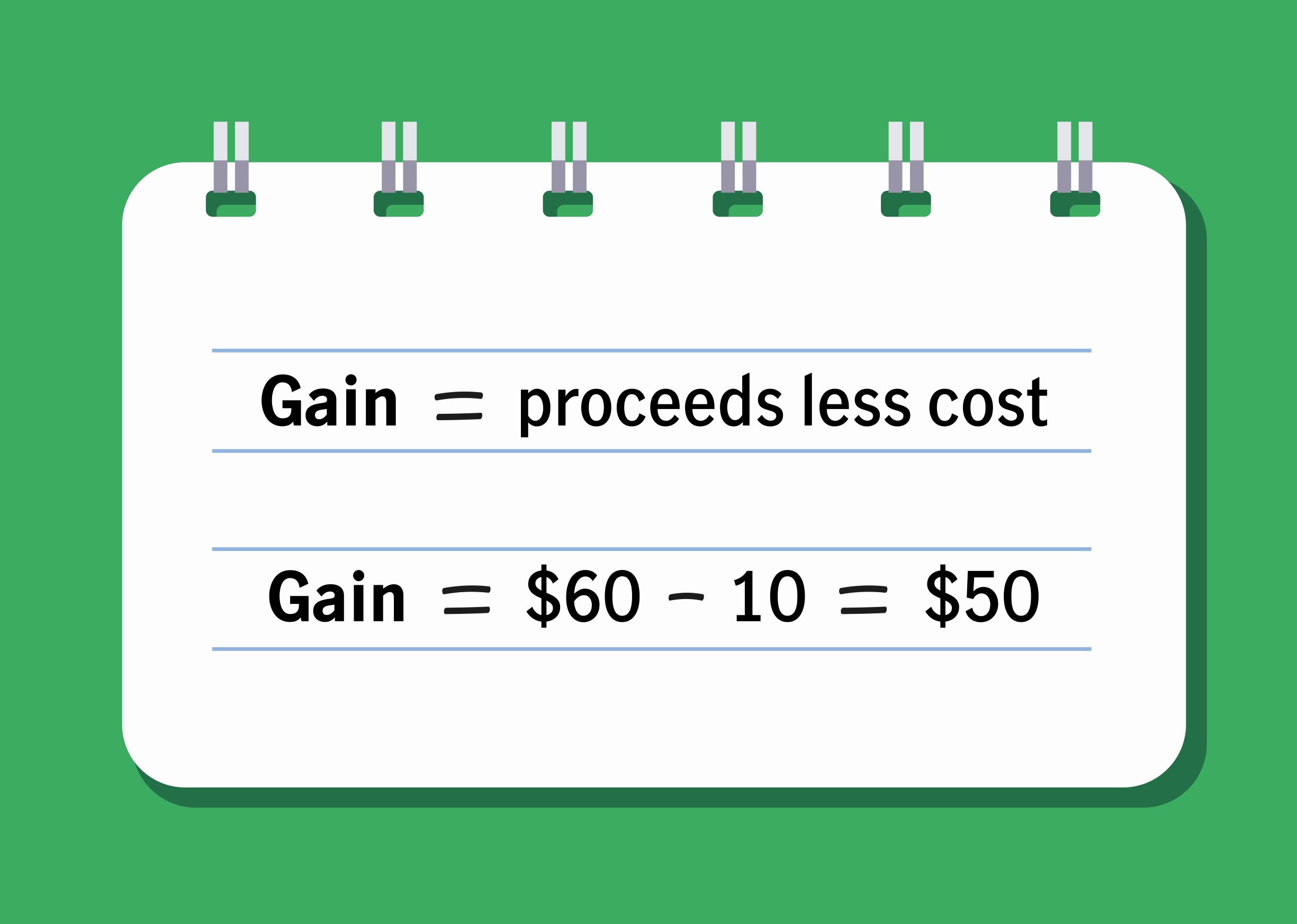

However, if the fund manager sold the stock instead, the taxable amount reported would be a capital gain of $50 – the difference between their purchase price of $10 and the sale price of $60. And as the investor, this amount would be taxable to you even though your investment in the fund has dropped in value.

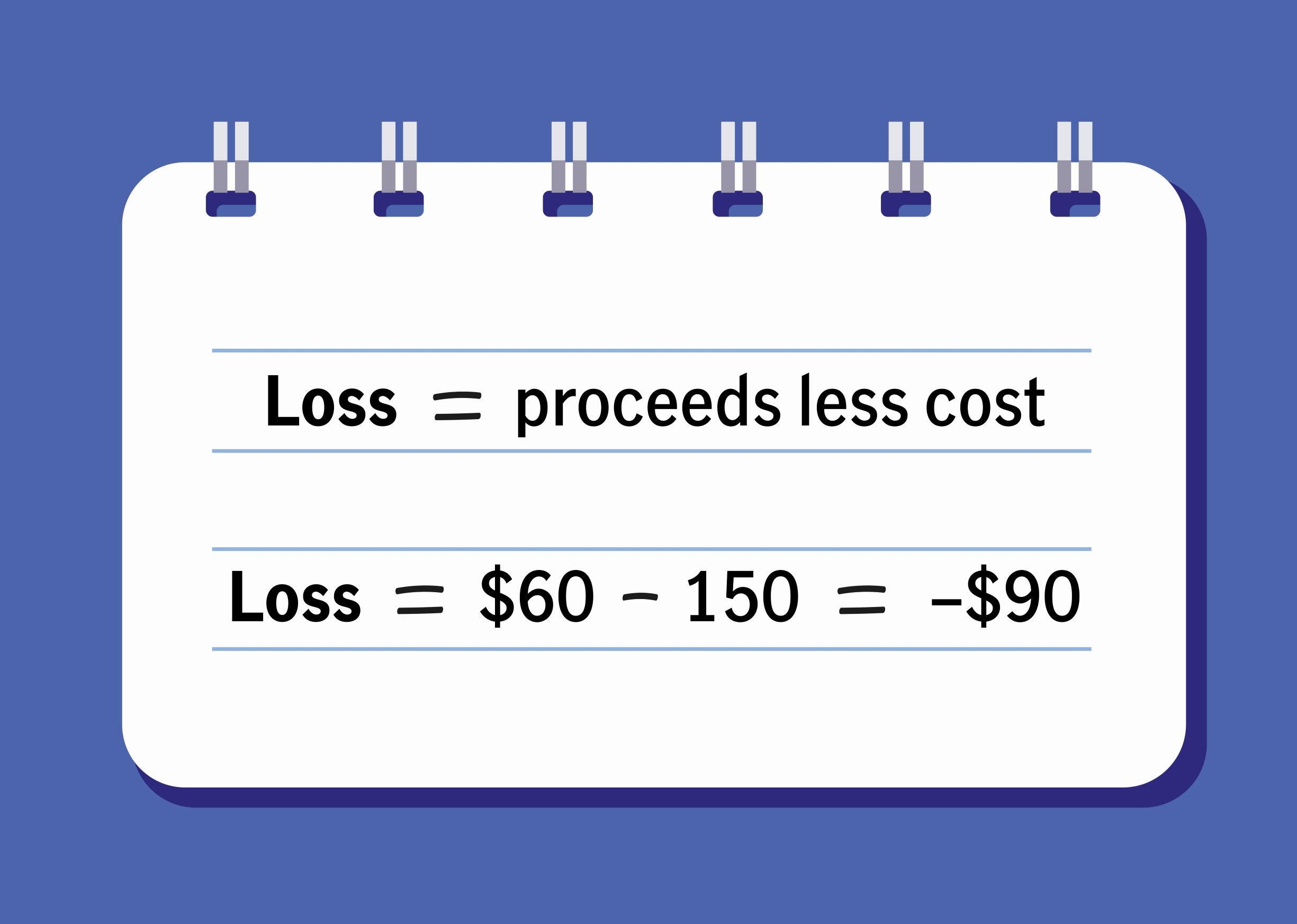

An investor never pays tax on more than they actually earn in profit. If you pay tax on the $50 gain, your cost is increased by that amount and is included when you sell the stock yourself. For example, if you sell the stock after receiving the $50 gain, your new cost is $150. If the stock is valued at $60 when you sell, you’ll now have a capital loss of $90.

Investing at year-end

At the end of the year, mutual funds often pay distributions and segregated funds often allocate to investors.[1] The distribution or allocation consists of income and capital gains received within the fund, and the amount is taxable. If significant year-end distributions or allocations are expected, consider investing in a dollar-cost averaging or money market fund to avoid the tax impact.

Strategies to consider when a capital gain is reported

Switch funds to realize capital losses and offset gains.

Switch to another fund to trigger a capital loss and recoup taxes already paid on gains. If the loss is more than the current year’s gain, you can carry it back to previous years to offset other gains.

Transfer capital losses between spouses.

If you haven’t incurred any capital gains this year or in the previous three years, but your spouse or common-law partner has, it’s possible to transfer capital losses to your spouse using superficial loss rules. Here’s how it works:

John purchased 100 shares in ABC Co. for $30,000. Later, he sells those shares for $10,000, realizing a capital loss of $20,000. If his wife, Jane, purchases 100 shares in ABC Co. within 30 days of John selling them, John’s loss is transferred to Jane for tax purposes under the superficial loss rules.

Jane then waits a minimum of 31 days and sells those 100 shares for $10,000, incurring a capital loss for tax purposes of $20,000, but no actual monetary loss for her. This allows her to claim John’s $20,000 loss against her taxable capital gains.

Talk to your advisor

There are a number of approaches you can take to reduce the impact of reported capital gains on your taxes. Your advisor can recommend the best strategy for your situation.

[1] Distribution date or allocation date can vary by product, i.e., mutual fund corporation, mutual fund trust and segregated fund contract, and by specific fund, i.e., some funds distribute or allocate periodically in addition to year-end while for money market and dollar-cost averaging funds, distributions and allocations of fund income are determined on a daily basis.