Retirement dreams – financial reality

Timeless strategies that can help your savings grow.

The freedom to enjoy life on your own terms, with plenty of time (and money) to travel, focus on your hobbies or do whatever your heart desires may come to mind first when you think of retirement. But funding this milestone stage of life takes planning, discipline and perseverance – and the sooner you start, the better.

How much do I need?

When building a retirement nest egg, there’s no hard and fast rule about how much you should be saving. The amount really comes down to the type of lifestyle you hope to enjoy when the days of earning a regular paycheque are over. A good place to start is mapping out your current expenses, and then making an educated guess about the projected cost of living in your senior years. Take into consideration that you may no longer have mortgage payments or child-care expenses, and your grocery budget may shrink if your kids move out. Or, you might have big plans that might require some financial foresight, like enjoying regular vacations or purchasing a retirement sports car. This retirement planning worksheet and retirement calculator can help you plan how much you may need to put away each month.

When considering retirement expenses, it’s helpful to think in terms of just two categories: Basics and non-essentials.

Basics are things you can’t live without, such as groceries, housing, health care, transportation, gas, heat and insurance. The price of many basics will depend on where you plan to live in retirement – so if you plan to move, calculate the difference in the cost of living.

Non-essentials are the fun things you want to do in retirement, such as eating out, joining a club or pursuing hobbies, entertainment and other leisure activities.

Understanding the magic of compound interest

Retirement may be (or feel) decades away, but the sooner you start saving, the better prepared you’ll be to enjoy your future. To make the most of your savings, it’s important to understand the power of compound interest. In simple terms, as the interest you earn is reinvested, it helps your savings grow faster over time.

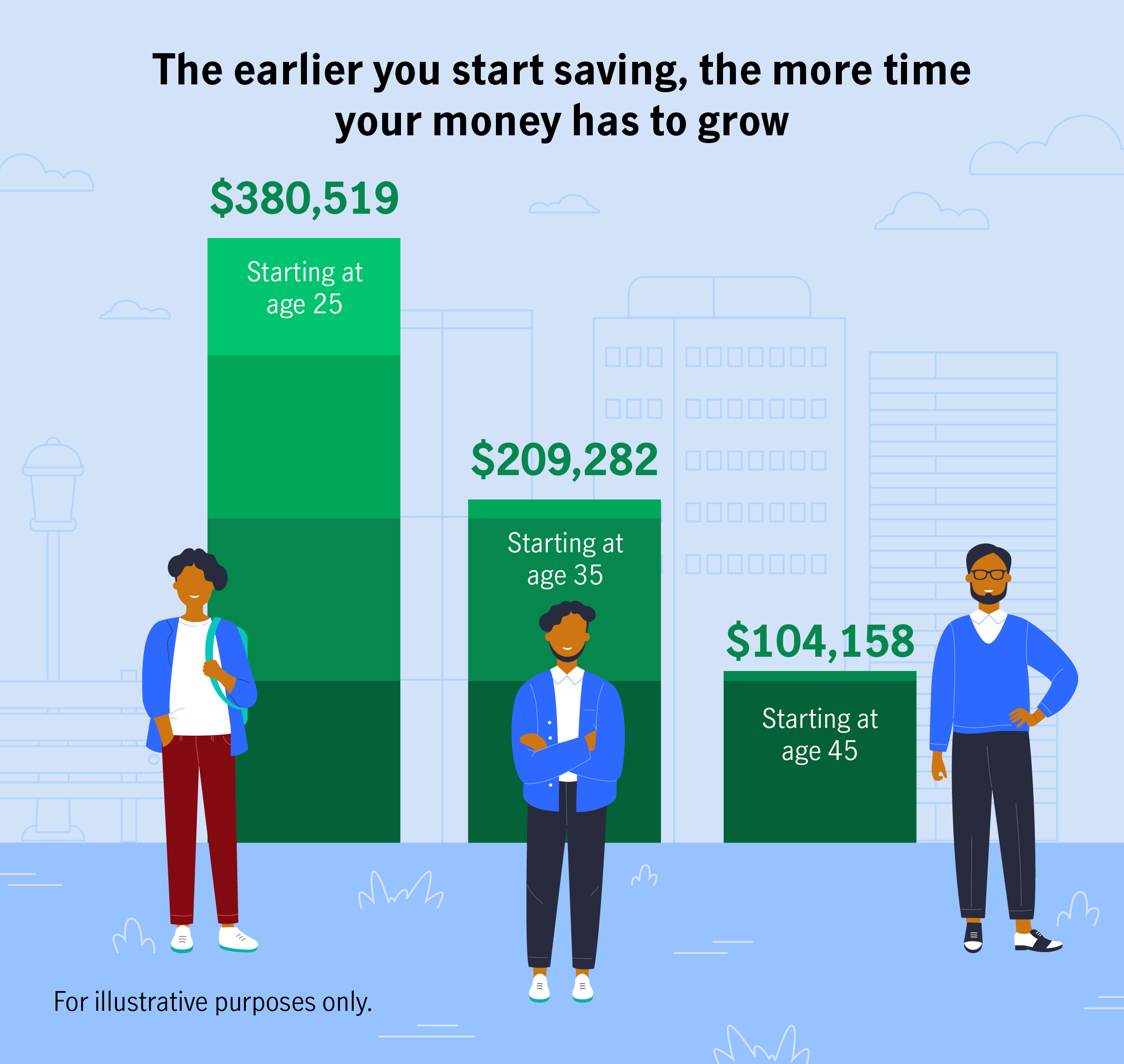

Let’s look at the effects of compound interest on an annual contribution of $3,000 to a retirement plan, assuming you’ll retire at age 65 and the investments earn an annual return of 5 per cent, compounded yearly.

- If you start saving at age 45, then you’ll have saved just over $100,000

- If you start saving a bit earlier, at age 35, then you’ll manage to save twice as much

- If you begin saving for retirement at age 25, you could have close to $400,000[1]

A few tips for maximizing the positive effects of compound interest:

- Contribute to a retirement plan on a regular basis – automatic weekly or monthly instalments directly from your paycheque or bank account make it easy

- If you have a group retirement plan through your workplace, take advantage of any matching contributions from your employer

- The earlier you begin saving, the better, but understand that it’s never too late to get started

- Increase the amount of your regular contributions when possible

- Put any extra money, such as a tax refund or an annual employment bonus, into your retirement fund

- Resist the urge to dip into your retirement savings

- Work with your advisor, who can help you achieve your retirement goals

Retirement ready?

The majority of Canadians can expect to live well into their 80s, so planning for at least 20 years of retirement living is reasonable. Considering a few questions can help you in the planning process:

- When do you want to retire? Knowing at what age you’ll step back from the workforce can help you determine how many years you’ll be saving for.

- Where will you retire? Whether you plan to relocate to a small town, stay in the family home, downsize to a condo or rent will have a big impact on the size of the retirement nest egg you may require.

- Do you plan to continue working? Maybe your idea of retirement is easing back from full-time hours to a more relaxed and fun part-time job. For many, a job offers a sense of purpose and belonging that boosts not only vitality but also the bank account. For a deeper dive into the benefits of working during your retirement years, check out this article.

- How will you spend your time? Downtime may seem idyllic if your working life was hectic, but too many idle hours make for long days. Think of how you hope to occupy yourself – it might be spending more time with family, travelling or volunteering.

- How might your health affect your spending needs? You may be healthy now, but it’s important to plan for potential what-ifs down the road. Consider the impact of therapies, mobility supports and assisted living on your retirement budget. [2]

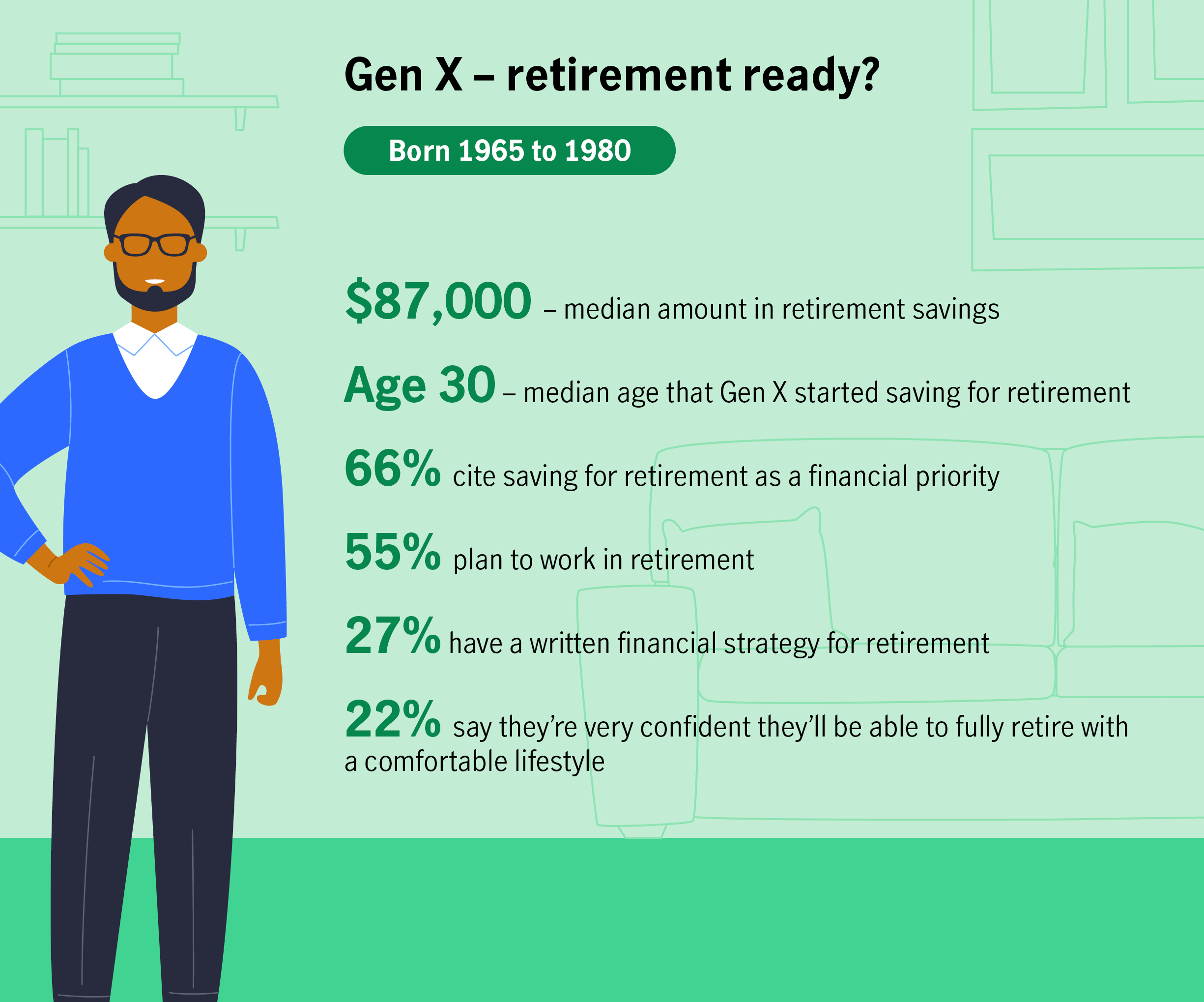

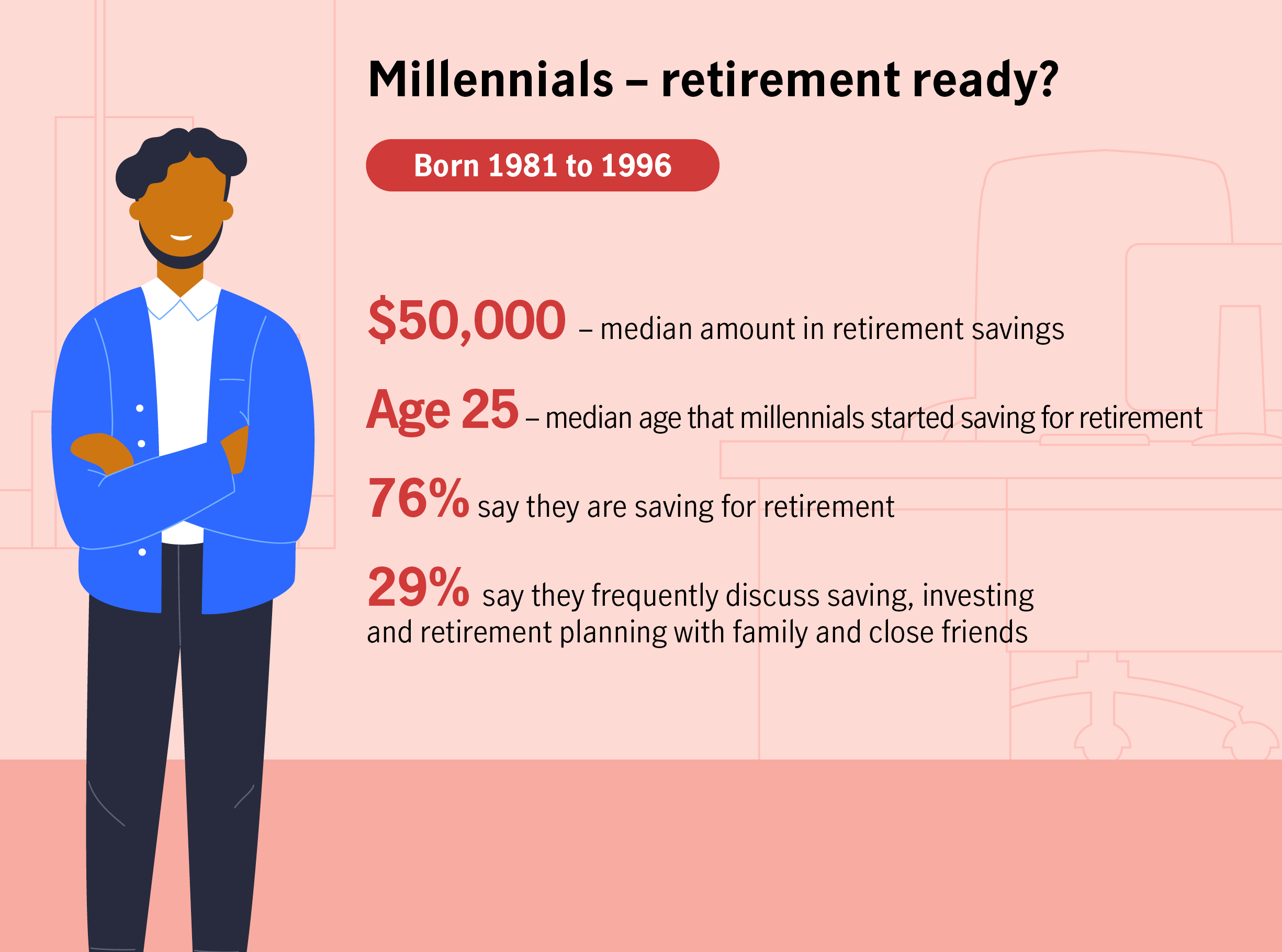

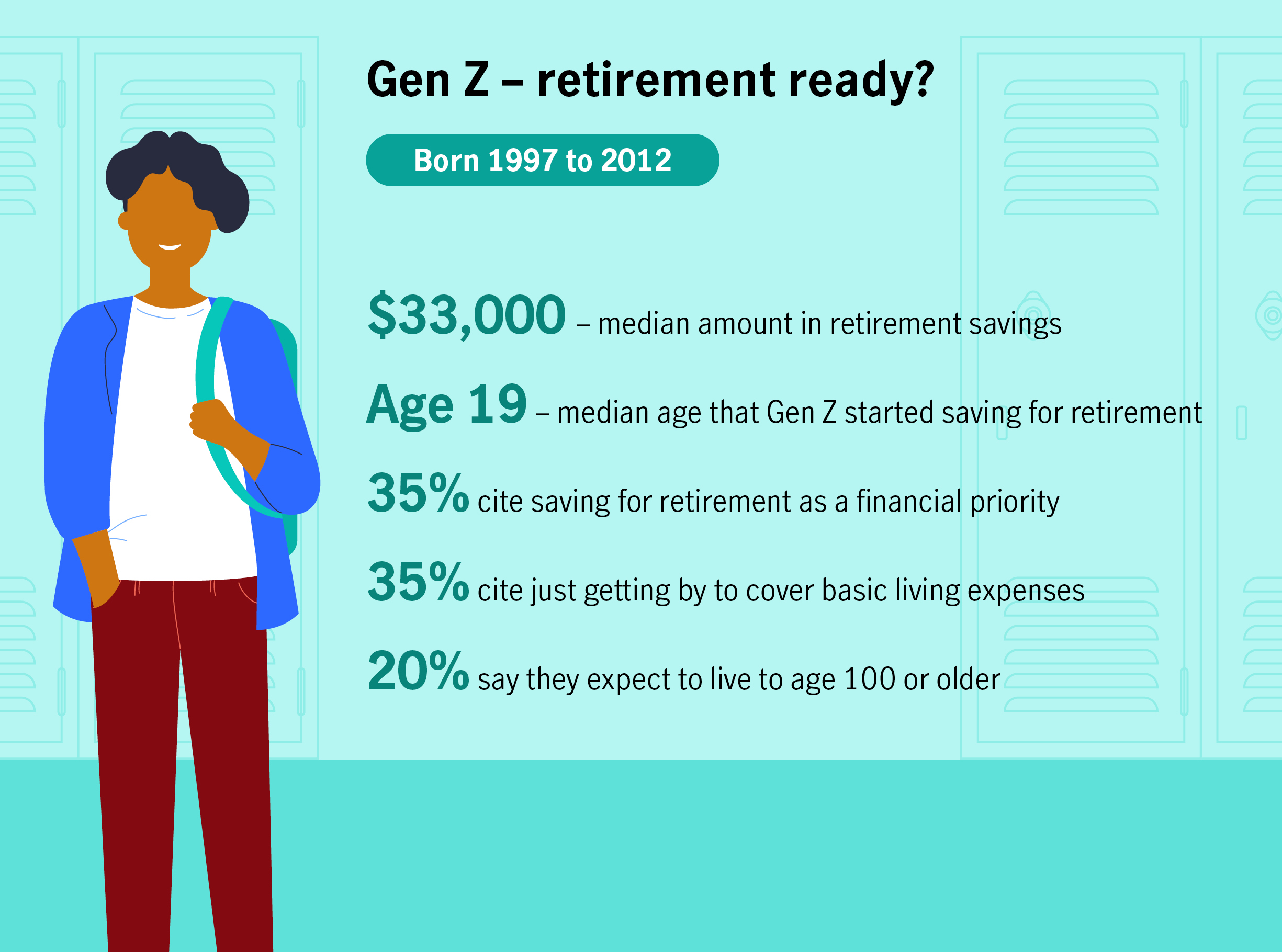

The baby boomer generation is already well into retirement, with the last of this group turning 65 by 2030. While boomers grapple with the reality of retirement, generation X is waiting in the wings, followed by millennials and then gen Z. How retirement ready are your peers? Here’s a quick glance at the retirement readiness of these major demographic cohorts.

*Report - Four generations prepare for retirement, p. 42, 2021

*Report - Four generations prepare for retirement, p. 43, 2021

*Report - Four generations prepare for retirement, p. 44, 2021

There’s no time like the present to save for your future, and your advisor can help determine the best options available based on your household budget, peak earning years and risk tolerance. For more information on planning for retirement and the power of compound interest, check out this video.